On Aug 2, 2013 the S&P 500 Index closed at 1709.67, an all-time high. On August 27th, the market had fallen roughly 5%, based on the possibility of war with Syria. Those actions are seemingly less likely, as the markets have come back to within 1.2% of the peak.

The question for the rest of the year is: “Will we forge ahead, tread water, or come down further?” If we look at the leading economic indicators, the answer would be a resounding ”We are going to move ahead of the peak reached earlier this summer”.

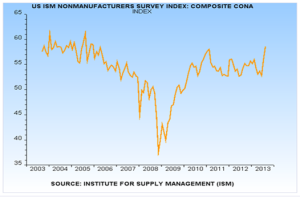

The last batch of ISM indicators show an expansion of growth, which should bode well for the markets. However, there are many bumps ahead from Fed decisions, which could create an uncertainty for investors. We are roughly 20 days from the government running out of money with no resolution. We have a debt ceiling that has reached the limit, with each side digging in their heels for a fight. Most of these Federal negotiations will end with compromise, or create a kick the can down the road mentality. This uncertainty will undoubtedly cause some volatility. If we go back to simple fundamentals, we are not trading at a premium to historical P/E, but we are also not that cheap either. Earnings this upcoming quarter will be more important than normal. We still are “muddling “ along.

You can follow Granite Group Advisors on LinkedIn and learn more about our Corporate Retirement Services and Wealth Management in our Website.