It is earnings season again on Wall street. We kicked off last week with mostly good numbers but at the same time see forecasts for the upcoming quarter a little dampened. This combined with the never ending Europe story caused markets to take a nice dip. Negative earnings expectations are predicted to be the highest since the 1st quarter of 2009, see below:

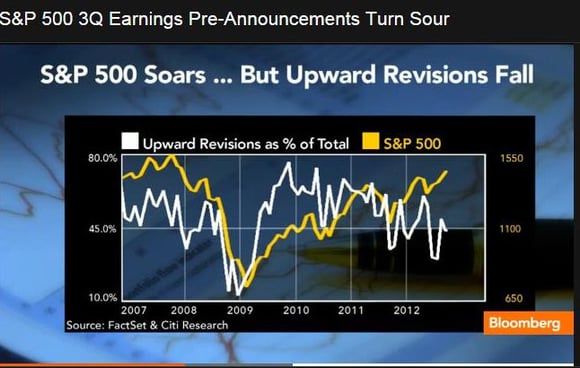

Adding fuel to the fire is the fact that while the S&P 500 continues to go higher, earnings expectations are falling, as illustrated below. This means that Wall Street is concerned about our economic recovery. We expect to be in a trading range here for a while as valuations have discounted the slow economic backdrop, but any catalysts such as QE3 actually working or some change to the EU situation will drive the market higher.